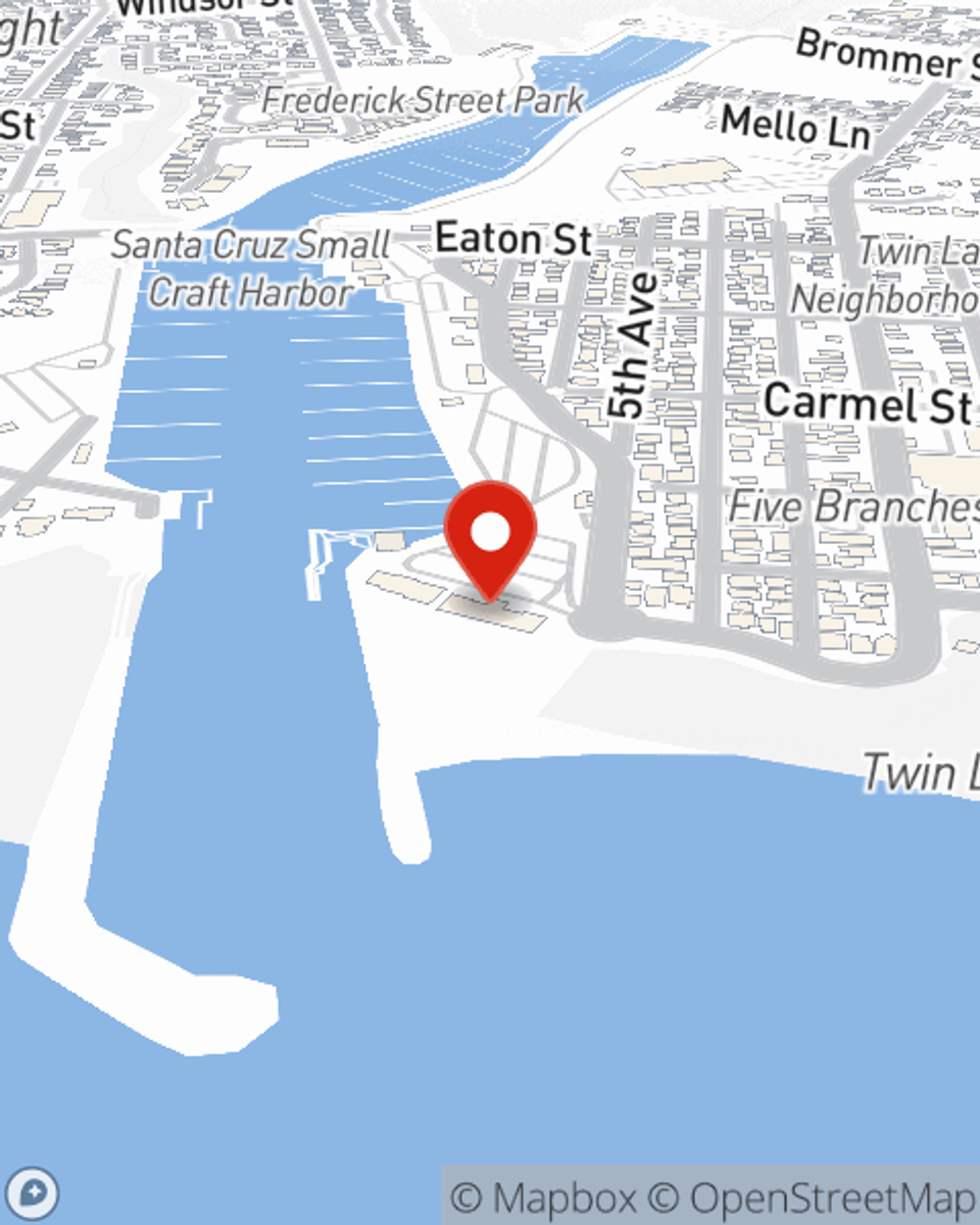

Life Insurance in and around Santa Cruz

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

Protect Those You Love Most

When you're young and your life ahead of you, you may think Life insurance isn't necessary when you're still young. But it's a great time to start looking into Life insurance to prepare for the unexpected.

Life goes on. State Farm can help cover it

Life won't wait. Neither should you.

State Farm Can Help You Rest Easy

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with providing for children, life insurance is definitely necessary for young families. Even if you don't work outside the home, the costs of filling the void of domestic responsibilities or before and after school care can be sizeable. For those who haven't had children, you may be planning to have children someday or be financially responsible to business partners.

No matter where you are in life, you're still a person who could need life insurance. Get in touch with State Farm agent Chris Buich's office to search for the options that are right for you and your family.

Have More Questions About Life Insurance?

Call Chris at (831) 464-4300 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Chris Buich

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.